If you’re considering selling multifamily property for commercial property due to Oregon Senate Bill 608, it is valuable to know the various 1031 exchange options available to you. Rachel McLaughlin, exchange facilitator with Cascade Title Company examines the different 1031 exchanges available to multifamily property owners. Find out which might be right for you and your investments.

[embedyt]https://www.youtube.com/watch?v=2cBEaB4lVX4[/embedyt]

Watch or Read

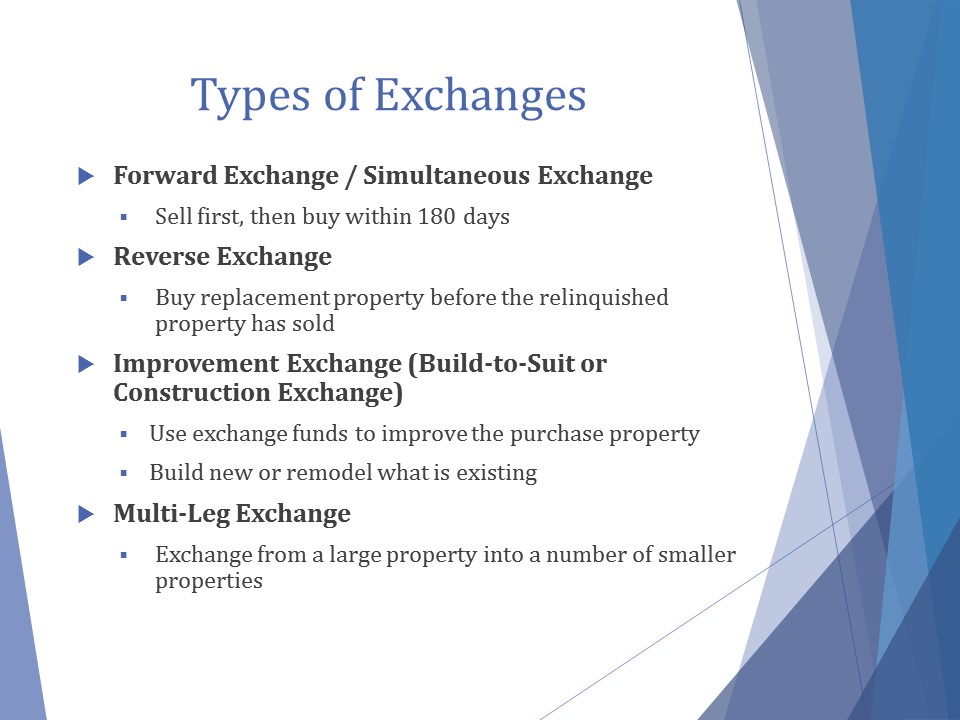

Four Types of 1031 Exchanges

Forward Exchange

We would pick the 1031 exchange that best fits your scenario. Forward exchange is the most common, also known as a simultaneous exchange. In a forward exchange, you sell first and then you buy second. You could do that within the 180 days, sell and then purchase within 180 days, or you could do it simultaneously. Some people are able to sell and purchase within the same day, that’s a possibility.

Reverse Exchange

The reverse exchange causes a lot of misunderstanding. Many people think this means that they did something wrong and they can reverse it, which is not the case. Once it’s done, it’s done. A reverse exchange just means that you purchase first and then you sell second. To do this, we have to set up a special purpose LLC, and we take title to the property that you are purchasing, and then we wait for your relinquished property to sell. You have 180 days just like you would with the other timelines to sell that relinquished property; that money comes into the exchange and we pay you back for your purchase, and then we transfer title at the end, which is when you take title to that property.

This is pretty common in this market because properties aren’t waiting. If you find a property that you really like, then you don’t have to wait for your relinquished property to sell, but you still want the tax benefit of an exchange, then you can do a reverse exchange. They work really well if you cash to do it. If you do not, we usually recommend you go to either a smaller bank or you find a private lender, because a lot of lenders don’t like to lend to somebody that’s not taking title to that property. Since the exchange is taking title, that makes it a little bit more complicated from the lending perspective. Another issue that can be a little tricky with a reverse exchange is if you do not sell your relinquished property within 180 days, your exchange dies and then you own two properties—and you have no tax benefit. That’s something to consider.

Improvement Exchange

The other type of exchange is an improvement exchange. These are my favorite. An improvement exchange allows you to sell your relinquished property and then purchase a property that needs some improvements. Of course, your ultimate goal is to purchase equal or up in value. In an improvement exchange, let say you sell for $300,000, you find a property for $200,000 that could use about $100,000 worth of work. So, we enter into an improvement exchange and the exchange takes title to that property while you do the $100,000 of improvements. Then by 180 days, the improvements are completed and we transfer title back over to you. Therefore, you taking title to a property that is equal or up in value from what you sold.

These are a lot of fun. You can either improve a property—a new roof, new plumbing, new kitchen, whatever is needed—or some people are able to build whole buildings in that timeline. It takes a lot of forethought though, if that’s something that you plan to do.

Multi-leg Exchange

The final type of exchange is a multi-leg exchange. This can work well for you if you have a portfolio that you would like to transfer out of. You can sell multiple properties and then purchase one big property. For instance, you might sell three properties and then transfer all of that into one bigger commercial property. The challenge with those is that you’re still under the same timeline. As soon as that first property sells, that starts your timeline. You have 180 days to complete your purchase and all of your sales.

Another challenge with these is that sometimes you might hold title in all your properties differently, and to do exchange you have to hold title exactly the same way that you sold. So, if you hold title as John Smith, you have to then purchase as John Smith, and some people, when you have a portfolio, you own your properties as all these different LLCs or in different ways. That can be a challenge.

If you need help with a 1031 exchange, contact Rachel McLaughlin, Exchange Facilitator.

If you need help with a 1031 exchange, contact Rachel McLaughlin, Exchange Facilitator.

Do you want to learn more? Visit Pacwest Commercial Real Estate’s Oregon Rent Control Central for the latest information.

Disclaimer

Due to the complex nature of these changes, Landlords should contact an attorney with any questions or clarification of Oregon Rent Control SB 608.

Recent Comments