With the passage of Oregon Rent Control SB 608 many multifamily property investors are wondering about the potential value implications of the new law. Zoe York, MAI Appraiser with Duncan & Brown, looks at the recent trends we’ve seen in rents and occupancy for multifamily in Eugene Springfield.

This background helps to illuminate why rent control was brought to the table and what kind of changes we can expect over time. Looking at history, trends, and what’s happening in the short term also provides tools for the risk assessment of your particular properties, which will help you to understand how vulnerable you will be to potential change.

[embedyt]https://youtu.be/IVEFdbh1yII[/embedyt]

Watch or Read

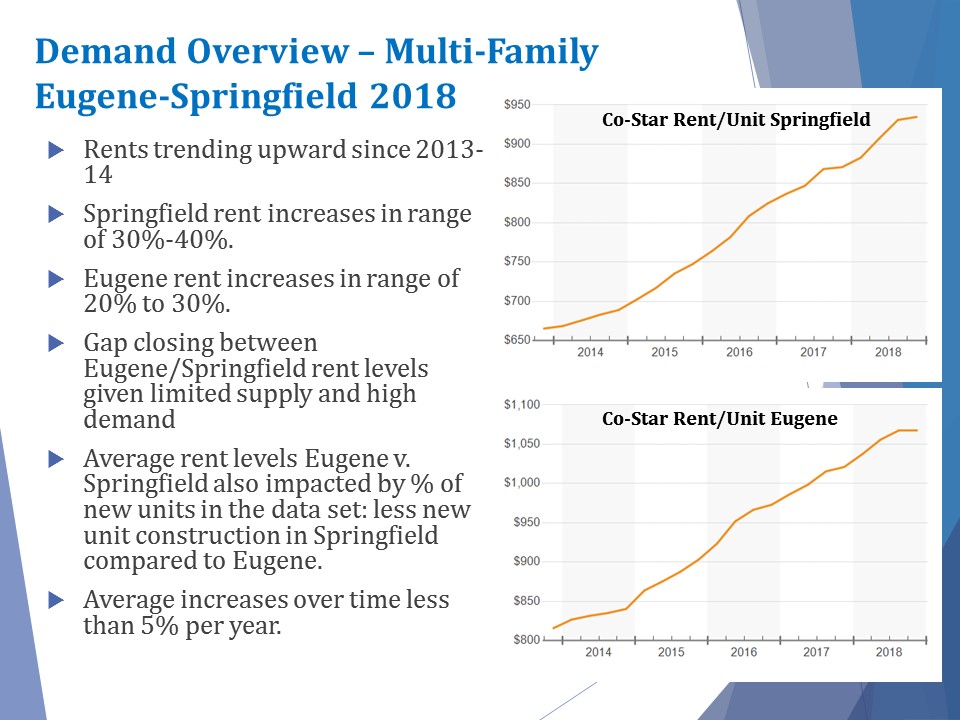

The figure here reveals a snapshot of what’s been occurring in our market—the rent increases that have occurred over the last few years. This figure includes all unit types, all ages, one bedroom, two bedroom, three bedroom in the entire city. But it reveals a very clear trend of what has occurred between 2014 and the present day, which is rent increases upwards of 30 to 40 percent in Springfield and 20 to 30 percent on average in Eugene. The reason for the difference between the two locations is that Springfield has historically had slightly lower rent levels than Eugene, so there was a lot more opportunity for upward movement, particularly as the rents grew in Eugene and pushed people outward into Springfield. The really important thing to understand about what’s been occurring with supply and demand and rent levels, with rents increasing dramatically and vacancy decreasing, is that we have a very limited supply in Eugene and Springfield of new units coming online.

Multifamily Construction Eugene Springfield

During the last decade, you saw a lot of construction happening in the campus market, but due to the recession, we didn’t see a lot of construction that wasn’t related to the University of Oregon. Many of us have seen new developments pop up in the last few years, so if you’re not tracking historic supply and demand, you might think we over-supplied and bringing too many units to the market. In fact, we had so little construction of market rate units during the last decade despite the increase in population that we are under supplied in the Eugene-Springfield market compared to other communities that have more land available and continued to construct over the last five years. The real challenge that we have here locally is that we don’t have a lot of land available that is feasible to develop. As long as we keep that construction at bay, we’re going to continue to have this problem where rents are continuing to increase because population is increasing and our construction isn’t keeping pace with population increases.

Rent Control Oregon SB 608

The critical thing to see here that relates to rent control is that the rent control legislation caps rent increases at 7 percent plus CPI per year, which is 10.3 percent for this year—a fairly dramatic increase. Historically, even though you’re seeing this 20, 30, and 40 percent over the last four to five years, over the last 20, 30 years our increases have not exceeded 5 percent per year. So, when you’re looking t the long range of your ability to increase rents, these trends might look really scary, but realistically, we haven’t seen increases at above that rent restriction year by year.

If you need assistance with appraisal services, visit www.duncanbrown.com.

If you need assistance with appraisal services, visit www.duncanbrown.com.

To learn more, visit Pacwest Commercial Real Estate’s Oregon Rent Control Central.

Disclaimer

Due to the complex nature of these changes, Landlords should contact an attorney with any questions or clarification of Oregon Rent Control SB 608.

Recent Comments