Rachel McLaughlin, exchange facilitator with Cascade Title Company, explains the ins and outs of 1031 exchanges. If you’re an investor in multifamily properties, you may want to consider a 1031 exchange into commercial property due to the new legislation about Oregon rent control. Learn about the safe harbor rules for 1031 exchanges so you can do things right.

[embedyt]https://www.youtube.com/watch?v=K5FKh6IdRGM[/embedyt]

Watch or Read

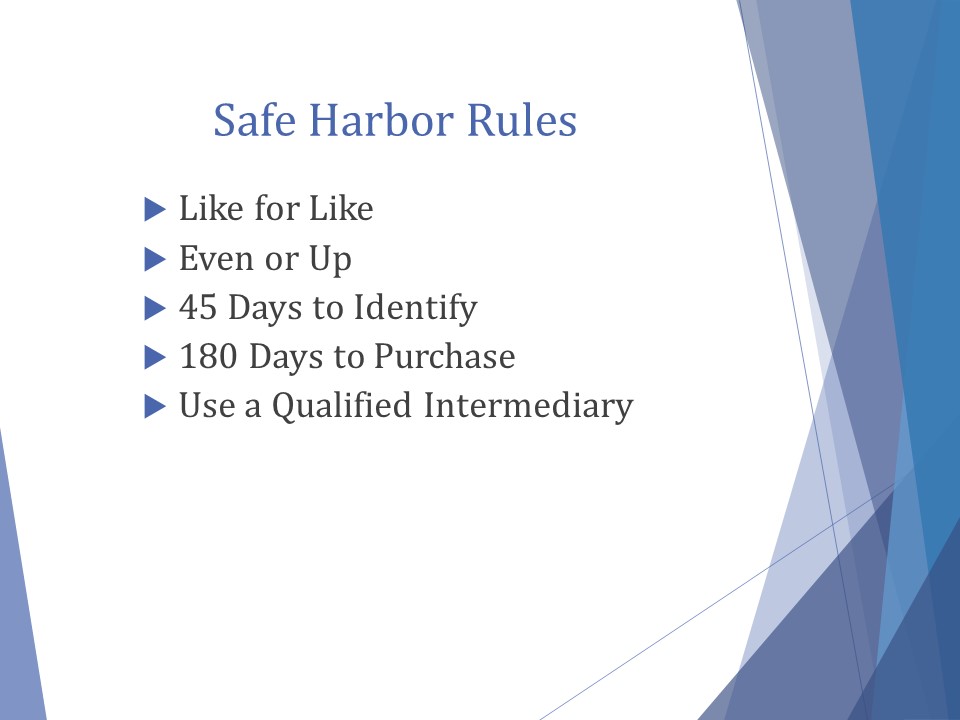

These are your Safe Harbor Rules. If you look at the handout that I have for you, they are like the giant stop signs. If you walk away tonight and this is the only thing that you remember, I feel like I have done a good job.

The safe harbor rules for 1031 exchanges are like giant stop signs. If you stay within the rules, you have a nice, clean exchange. The safe harbor rules that the IRS has put forward say that you have to exchange like for like property. What they mean by like for like is that if you are selling a property that you held for business or investment, then you can purchase a property that you intend to hold for business or investment.

Safe Harbor Rules for 1031 Exchanges

There are a couple different types of properties out there, so as long as it’s real property, you can go from a commercial building to vacant land. You can go from vacant land to let’s say, a duplex. You can go from a duplex to a single family home, and then back to vacant land. Those are all like for like, as long as they are held for business or investment purposes.

The next rule is that you need to go even or up in value when you purchase. If, for example you sell for $250,000, you need to purchase for $250,000 or more if you want to be fully tax deferred on your exchange.

As far as the timeline, you need to identify properties within 45 days you have to purchase within 180 days, so that means that the deed records within 180 days on your purchase end.

Finally, you need to use a qualified intermediary, who makes sure that the exchange goes properly. We make sure that the deed has the correct verbiage on it. We make sure that the closing statement reads correctly for the exchange. We also hold your funds.

If you need help with a 1031 exchange, contact Rachel McLaughlin, Exchange Facilitator.

If you need help with a 1031 exchange, contact Rachel McLaughlin, Exchange Facilitator.

Do you want to learn more? Visit Pacwest Commercial Real Estate’s Oregon Rent Control Central for the latest information.

Disclaimer

Due to the complex nature of these changes, Landlords should contact an attorney with any questions or clarification of Oregon Rent Control SB 608.

Recent Comments