Many multifamily property investors are wondering how Oregon Rent Control SB 608 may impact the value of their properties. Zoe York, MAI Appraiser with Duncan & Brown, looks at the history of market trends with multifamily properties in Eugene, Lane County, Oregon. Looking at gross rent multipliers (GRMs) is the way appraisers look things. We’ll look at a snapshot of where we were pre-recession, where we were in the recession, and where we are now.

[embedyt]https://youtu.be/Gb3vqrId7sA[/embedyt]

Watch or Read

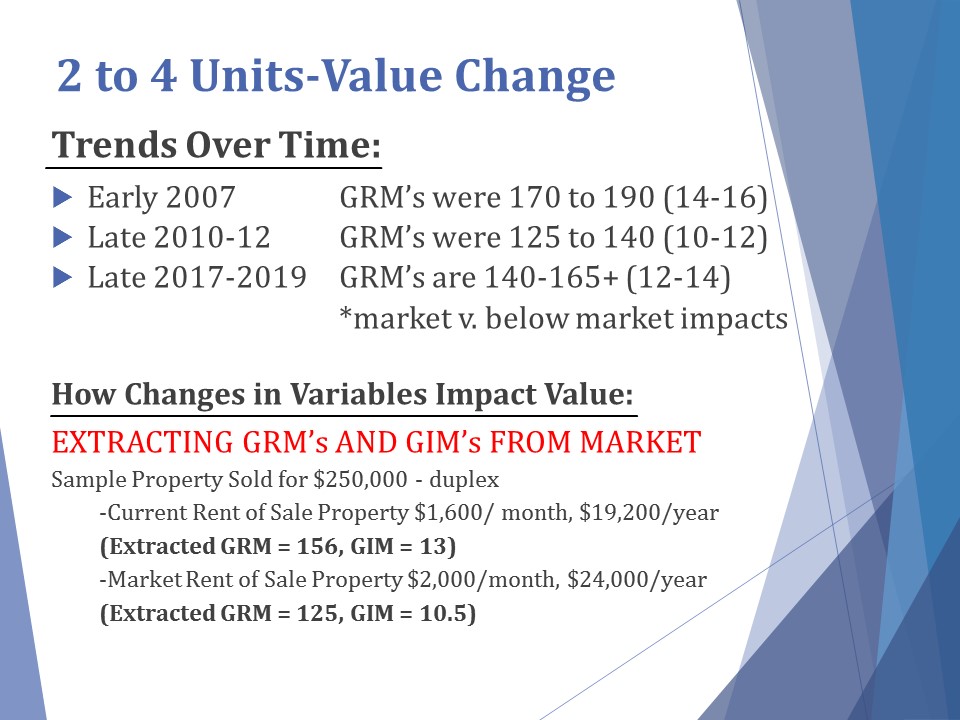

In early 2007, GRMs were 170 to 190, or your income multiplier and annual was 14 to 16, which is pretty inflated. During the recession it was down to 125 to 140. More recently, from 2017 to 2019, we’ve seen 140 to 165 and even higher. The reason that I have a caveat to that of market versus below market rent impacts is that, this formula gets applied to your rent.

In the last few years as rents have continually gone up pretty significantly, appraisers, investors, and brokers all have had to be really careful about how they’re extracting these GRMs from the market, because many projects are rented below market now. This is particularly an issue with projects that are owner managed, or that haven’t necessarily kept their portfolio up to the market pace. This doesn’t mean they’re poorly managed, but it’s just the market has changed so dramatically year after year. So we’ve seen a lot of projects below market rent and this is how to get GRMs in the market to apply to a property: we extract them from sales.

For example, we take a sale at $250,000 for this hypothetical duplex and extract out the monthly or annual rent. To do that, you take 250 divided by whatever rent factor you’re using and that’s how you get the GRM or the gross income multiplier (GIM).

“What we’ve seen in the last few years, unfortunately, is a lot of improperly applied formulas because, if you are just taking a property that’s below market rent, that hypothetical duplex $800 per side, the market rent, let’s say for that duplex is $1,000 per side.”—Zoe York

If you just take this sale property, 250 divided by whatever the rent is, you don’t look at the market, you just divide it by what they’re getting, your GRM is going to be 156. If you take the market rent of that property, divide 250 divided by the market rent, you’re GIM is 125, and that’s a pretty substantial factor when you’re saying, okay, I’m going to go to the market, take these sales, extract GRMs and apply them to my subject property, or apply them to my investment and see what the value should be.

That’s a significant difference when you’re using that multiplier.

If you need assistance with appraisal services, visit www.duncanbrown.com.

If you want more information on Oregon Rent Control SB 608 and its impact on value change in multifamily housing, visit Pacwest Commercial Real Estate’s Oregon Rent Control Central.

Disclaimer

Due to the complex nature of these changes, Landlords should contact an attorney with any questions or clarification of Oregon Rent Control SB 608.

Recent Comments